\boxed{“`html

The Surging Demand for Humanoid Robot Rentals in China

In recent years, the humanoid robot industry in China has undergone a period of explosive growth. This rapid development is not only marked by significant advancements in technological innovations and practical applications but also by the emergence of robust demand in a related market segment: humanoid robot rentals.

A humanoid robot made by Hangzhou-based robotics start-up Unitree greets spectators with handshakes at the China International Fashion Fair in Shanghai on March 13, 2025. Photo: VCG

Rising Demand in Humanoid Robot Rentals

Leading voices within the industry have revealed an unprecedented surge in demand for humanoid robot rentals. For instance, Yu Jian, general manager of Jike Robotics, a company that both manufactures and rents out robots, shared insights with the Global Times on the intensifying market demand.

Unitree Robotics G1 Model: An Industry Favorite

“The G1 model from Unitree Robotics has received the most orders, with a daily rental fee of about 10,000 yuan ($1,400). We possess five Unitree G1 units, and by early March, all rental slots for the month were fully booked,” Yu stated. Given the high demand, Jike Robotics plans to acquire an additional three Unitree G1 units. These rented humanoid robots find applications in an array of sectors including real estate marketing, automotive industries, livestreaming, and education.

Another Company Riding the Tide

Land Mark, another prominent entity in the realm of robot rentals and digital intelligence services, has also observed a significant uptick in demand following the Spring Festival. Zhao Binran, general manager of Land Mark, shared that the company officially launched its robot rental service in February and has since experienced a steady stream of orders and inquiries.

“Previously, we received one or two customer inquiries per day, but now we handle 10 to 20 daily, with a significantly higher conversion rate. For every 10 inquiries, we typically secure two or three orders,” Zhao reported. The majority of these rental orders—about 50 percent—are for exhibition guidance and event planning. Another notable category includes businesses or factories that rent robots for daily reception duties over a fixed period.

The Challenge of Meeting Surging Demand

Such burgeoning demand poses a challenge for companies struggling to keep up. Zhao mentioned that Land Mark possesses eight Unitree G1 robots, out of which five are allocated for rental while three are reserved for research and development. Due to pressing rental demands, Zhao finds himself frequently debating whether to rent out those units originally intended for R&D activities.

Technological Advancements Fueling Robot Market Growth

This rising demand for robot rentals mirrors the robust growth of China’s robotics sector. The advancements in humanoid robots are propelled by the combined efforts of innovative start-ups and sophisticated technological groundwork.

Unitree Robotics’ Open-Source Approach

A representative from Unitree Robotics commented on these developments: “We are committed to further advancing the robot industry. To this end, we have opened our robot interface data and have made numerous software tools available as open source.”

Diverse and Comprehensive Strategies in the Robot Rental Industry

Industry experts note that China’s robot rental market doesn’t hinge on single-brand dominance but thrives on the foundation of improved after-sales service and maintenance networks. The main objective here is diversification and comprehensiveness aimed at effectively addressing consumers’ practical needs.

Future Market Projections

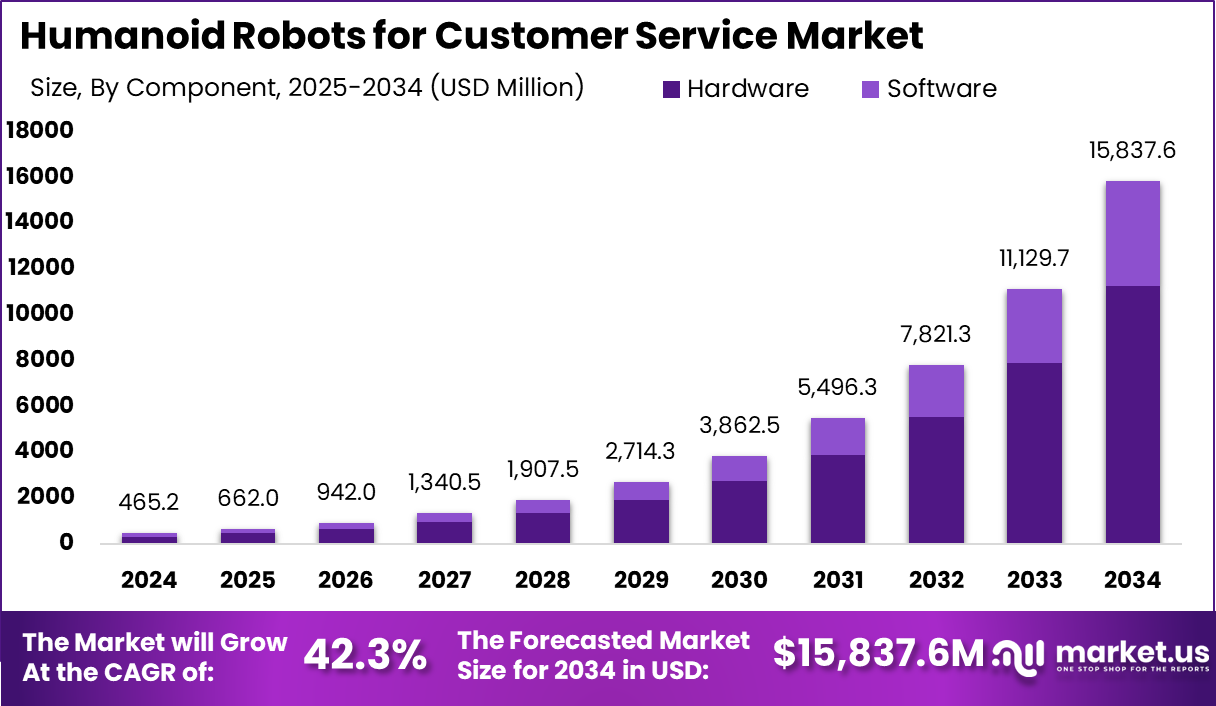

The projected growth figures for China’s humanoid robot market are impressive. Chinese Institute of Electronics data indicates that the market is expected to reach a scale of around 870 billion yuan by 2030.

Breakthroughs in Technology

Recent technological advancements further bolster the momentum within China’s robotics industry. A notable example is the “BeamDojo” reinforcement learning framework, developed jointly by the Shanghai Artificial Intelligence Laboratory, Shanghai Jiao Tong University, and other institutions. This framework is engineered to enable humanoid robots to move flexibly on sparse footholds. Widely reported by the Securities Times, “BeamDojo” has been applied to Unitree Robotics’ G1 humanoid robot, allowing it to perform complex tasks such as walking on a balance beam and navigating stepping stones. Remarkably, the robot maintains precise and smooth movement even when carrying heavy loads or being subjected to external forces.

Conclusion

The surging demand for humanoid robot rentals in China underscores a dynamic intersection of rapid technological strides and expanding practical applications. With significant contributions from companies such as Unitree Robotics and a proactive stance by rental firms such as Jike Robotics and Land Mark, the humanoid robot market in China is set for a vibrant future. This market’s growth is reinforced by strategic open-source initiatives from leading developers and robust national market projections that forecast a nearly trillion-yuan industry by the end of the decade.

As technological innovations like “BeamDojo” elevate the functionality of humanoid robots, the rental market segment is likely to continue its upward trajectory. Reflecting on these developments, one can only anticipate what the next breakthrough in China’s humanoid robotics industry will be and how it will further revolutionize various sectors such as real estate marketing, vehicle industries, livestreaming, and education.

“`}

Leave A Comment