\boxed{“`## Tesla’s "Musk Effect" Takes a New Turn: A Deep Dive into Today’s Tesla Trade-in Trends and Future Robot Ambitions

I’ve been closely following Tesla for the past few months, and what’s unfolding is remarkably intriguing. The "Musk effect" is currently experiencing an unforeseen turn as an unprecedented number of Tesla owners are trading in their cars for models from competing brands. As someone deeply invested in both automotive trends and technological innovations, this development is worth a closer look.

Tesla’s Challenging Market Position Amid Increasing Competition

You might be surprised to know that Tesla’s stock has tumbled by a stunning 42% since the start of this year. Although there was a brief surge following the November election victory of Trump, investors have been rapidly divesting, which paints a worrying picture for the once-dominant electric vehicle (EV) pioneer.

Tesla is not only encountering financial challenges; its market leadership is genuinely under siege. According to January data from S&P Global Mobility, Tesla’s US sales have declined by roughly 11% compared to the previous year. On the other hand, established automakers such as Ford, Chevrolet, and Volkswagen are making significant inroads into the EV market, reflected in their robust sales growth.

The situation is even more alarming for Tesla aficionados when it comes to buyer interest. Edmunds’ recent reports show that interest in new Tesla models plummeted to a mere 1.8% last month, the lowest since October 2022 and down from a peak of 3.3% in November. This downturn in consumer interest could potentially redefine the electric vehicle market landscape.

| Metric | Current Value | Previous Peak | Change |

|---|---|---|---|

| Tesla Stock Performance (YTD) | -42% | Post-Trump victory surge | Significant decline |

| US Sales Growth | -11% | Market leader position | Negative trajectory |

| Buyer Consideration | 1.8% | 3.3% (Nov) | 45.5% decrease |

Musk’s Robot Legion: A Strategic Pivot or Distraction?

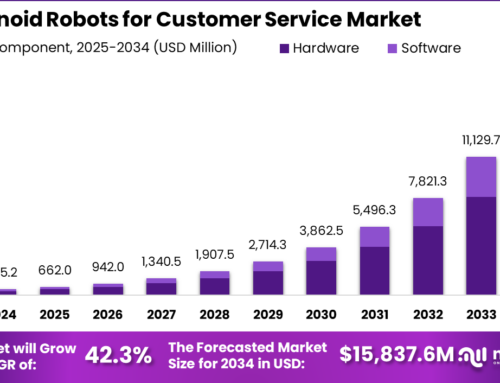

Amid the market challenges, Elon Musk is pursuing yet another audacious project. During Tesla’s first-quarter meeting, Musk announced plans to produce around 5,000 Optimus humanoid robots this year. His comparison of this quantity to "a Roman legion" is both fascinating and slightly disconcerting.

But Musk’s aspirations extend even further. He projects a tenfold increase in production, aiming to make approximately 50,000 units next year. The anticipated timeline for the deployment is also of particular interest; Musk claims that these humanoid robots will be ready for use outside controlled Tesla environments by the second half of 2026.

Regarding who will be first to use these groundbreaking robots, Musk states that Tesla employees will have priority access—a potential morale booster for employees during a challenging phase. The deployment plan appears to be structured as follows:

- Internal testing in controlled Tesla environments.

- Prioritized availability to Tesla employees.

- Wider deployment outside Tesla’s controlled settings.

- Potential commercial availability.

The Future Balancing Act for Tesla and Its Investors

2025 is poised to be a pivotal year for Tesla, as it attempts to balance its position in both the automotive and emerging robotics sectors. With traditional car manufacturers making rapid advancements in the electric vehicle domain, Musk appears to be reaffirming his commitment to diversification through robotics.

This all raises some important questions. Is Tesla possibly shifting its focus from its fundamental automotive business to venture into robotics? Alternatively, could this be a strategic and necessary evolution for a company that has consistently defined itself as more than an automobile manufacturer?

For investors or potential consumers, these developments warrant close scrutiny. The trade-in trends indicate that competition is heating up in the electric vehicle market, which might offer consumers more options at potentially better values. Simultaneously, the robotics initiative could either be a brilliant strategic pivot or a worrisome diversion from Tesla’s automotive struggles.

One thing is clear: Tesla maintains a position at the forefront of technological ambition. Whether that will translate into market success across both sectors is one of the most thrilling questions in the current tech landscape. We will be closely monitoring how these parallel narratives unfold throughout 2025.

Sam Johnson is a software engineer and tech enthusiast who specializes in web development and digital infrastructure. A graduate with an engineering degree in software development from MIT, Sam leverages his technical background to provide readers with an insider’s look at the mechanics behind today’s biggest tech stories. At HSUOracle.com, he delves into complex topics like cybersecurity and AI development. In his free time, Sam enjoys mountain biking, often exploring rugged trails across the Pacific Northwest.

“`}

Leave A Comment